We are a local business that prioritizes customer service. We are intensely focused on making your payroll less of a burden, and when you need immediate support from a local payroll support professional, just give us a call. We’ll answer the phone.

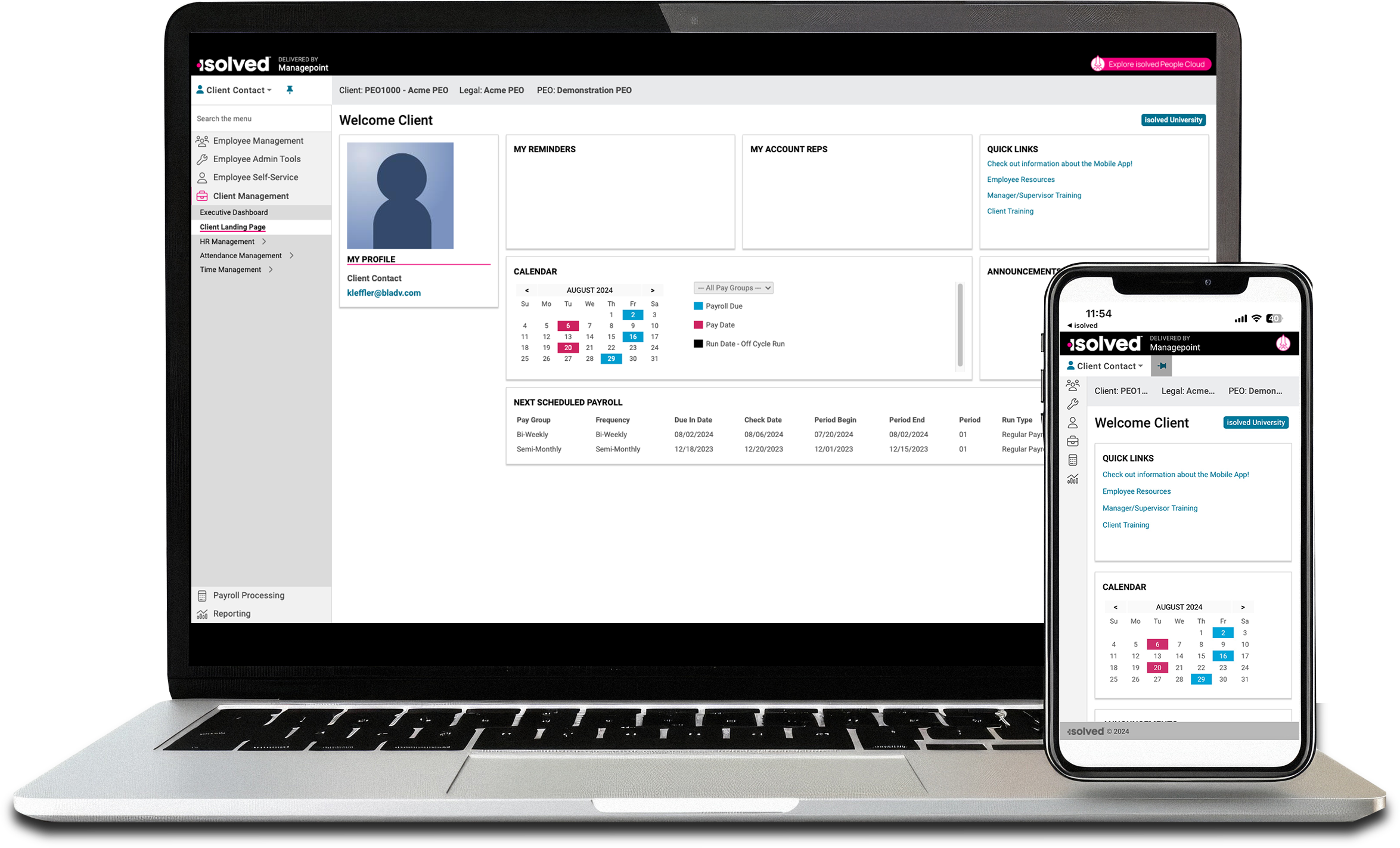

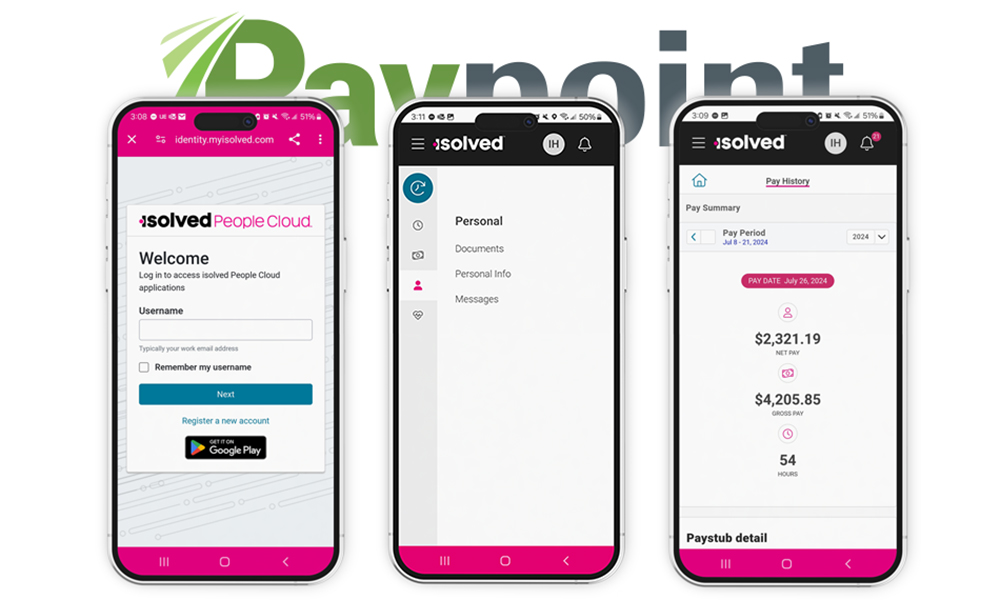

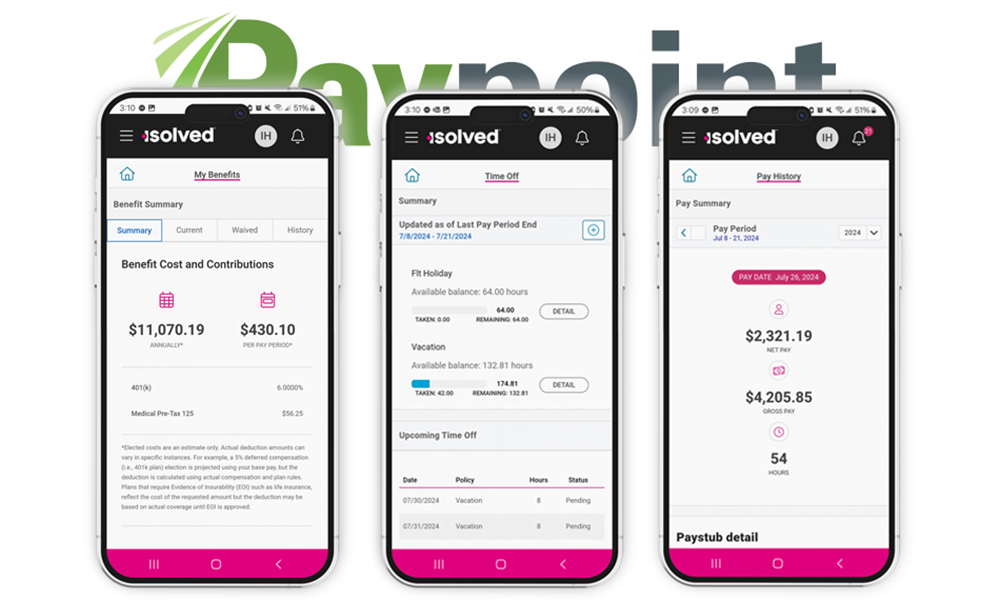

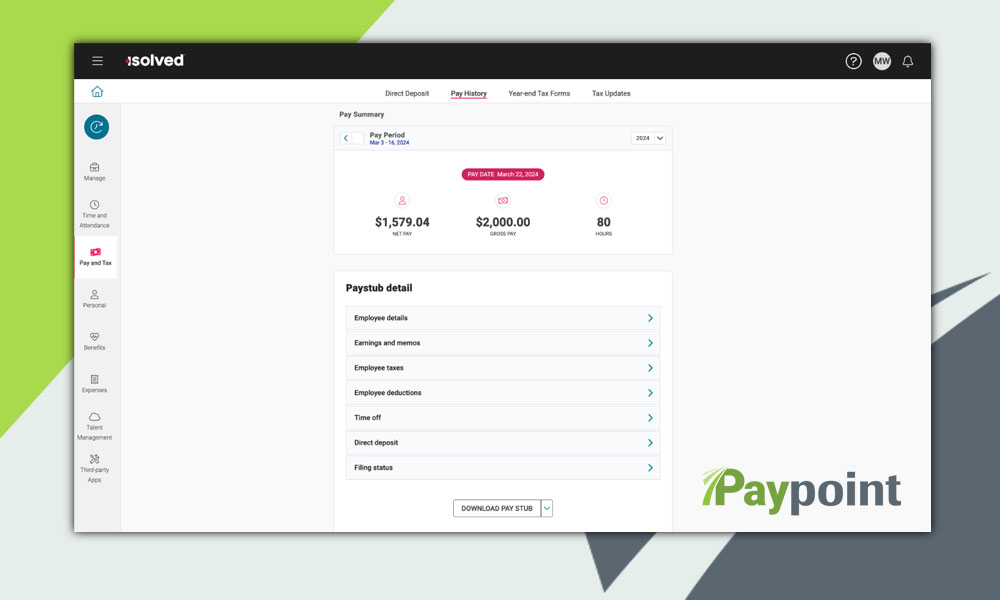

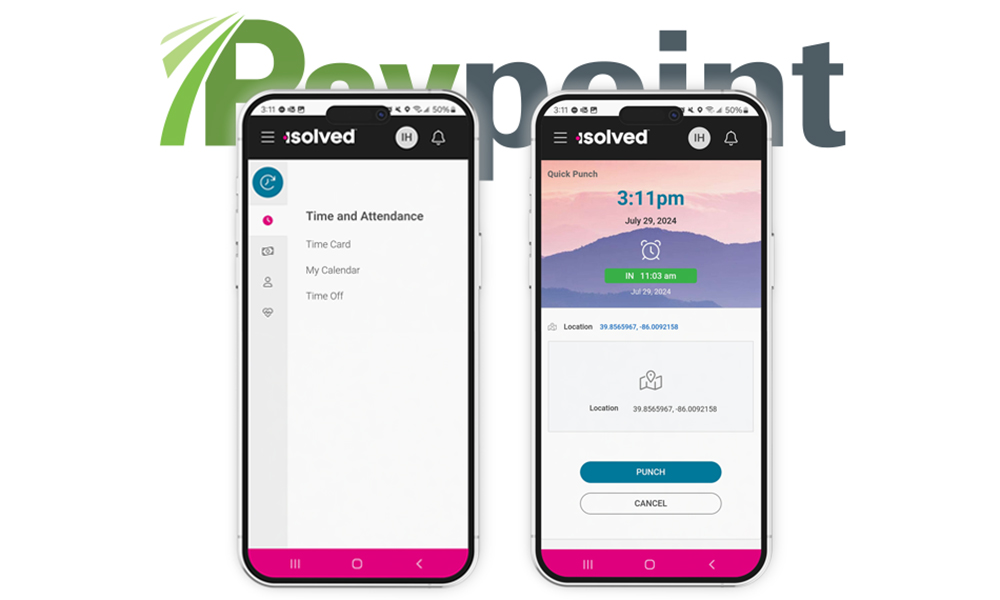

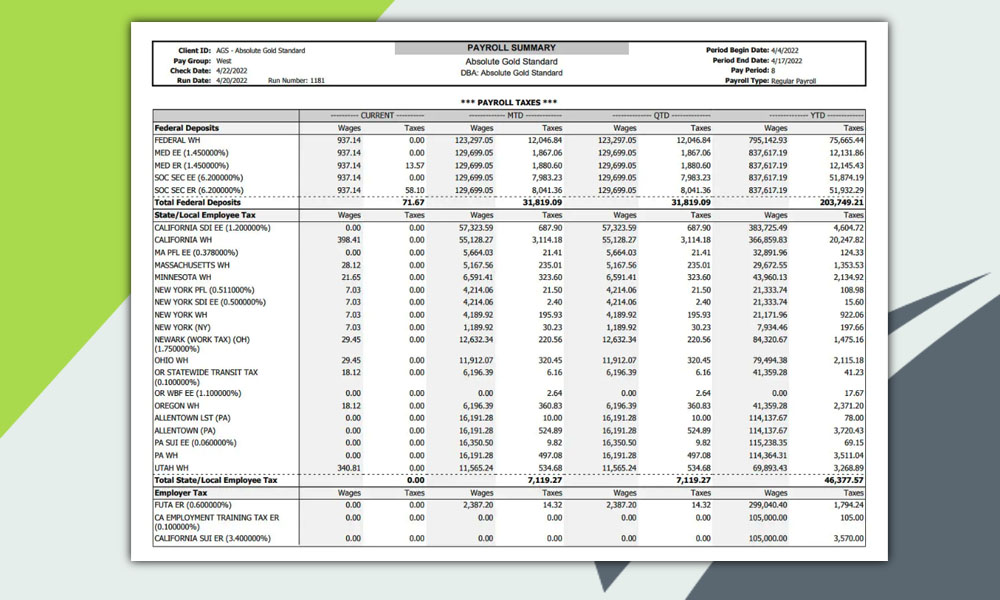

Managepoint introduces PayPoint, powered by iSolved – offering today’s best solution for full-feature payroll management.

For the Employer, for the Employee:

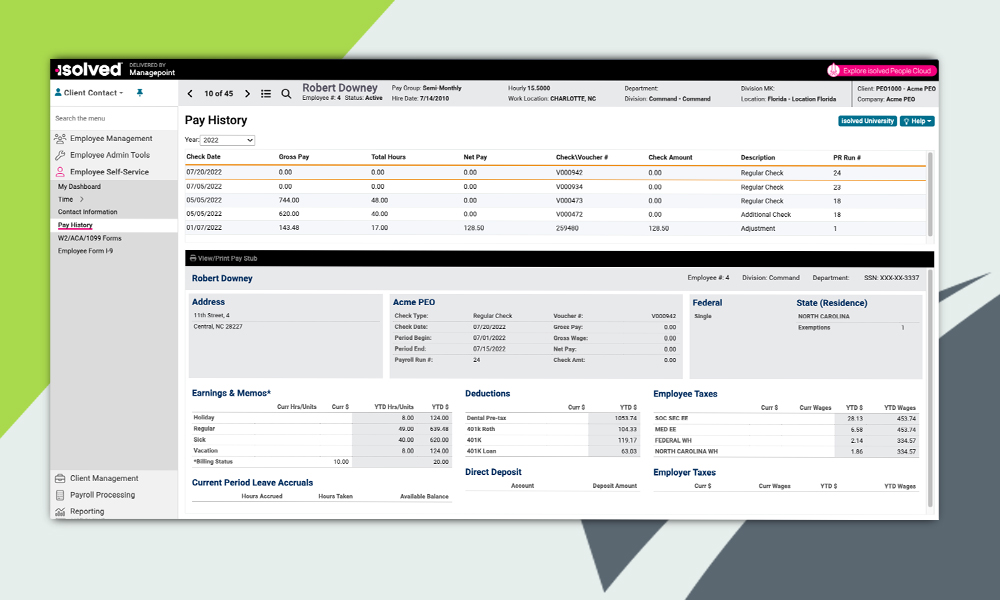

- Accurate, timely payroll processing

- User-friendly self-service (direct deposit, personal information, tax filing and more)

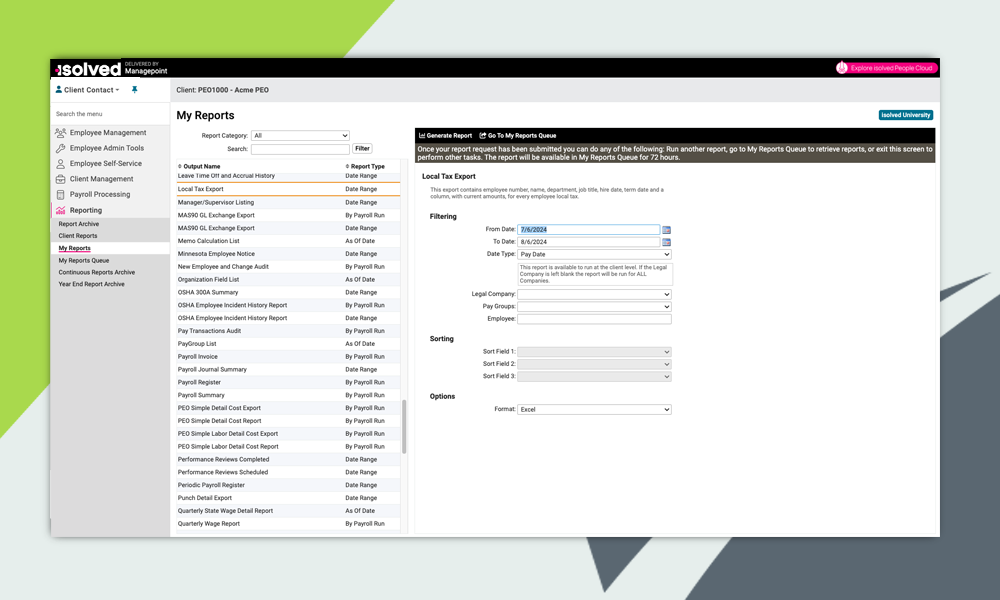

- Real-time Calculations: Tax rates, calculations, reports, and much more – always accessible

With Managepoint’s local payroll support team, there has never been a better full-service, fully accessible payroll experience for small business!